부키

어제

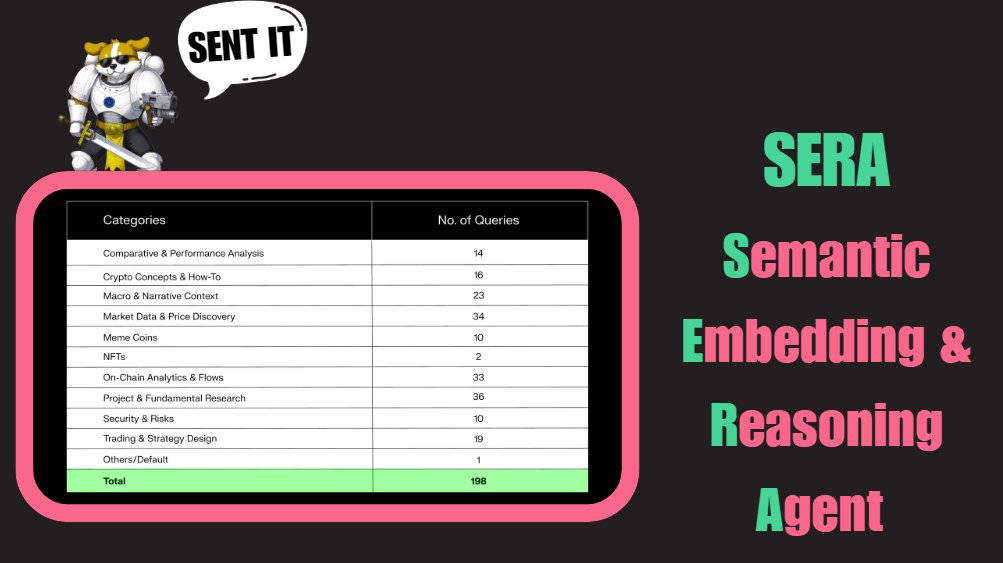

SentientAGI, 새로운 AI 아키텍처 SERA 도입했다는데 폴리곤 부활 신호탄인듯

첨부 미디어

i still believe BELiEVE @SentientAGI will cook

don't you? or have you lost faith, anon ...

> here's my reason nr. #102 - SERA > bonus* - could @zama be deployed on Sentient?

< 1. what SERA is >

SERA aka Semantic Embedding & Reasoning Agent

it's Senti's new architecture for https://t.co/xV2GXcKChB

인용된 트윗: i think @SentientAGI will cook

here's why (just fax no fluff) 👇

@sandeepnailwal has poured his heart and soul into building this

he's gathered the most brilliant minds in open source AI

Senti & @katana are Polygon's big shot at redemption & the oportunity to show nay sayers like @Trader_XO that they've got what it takes

Polygon has recently onboarded Calastone (with a volume of more than £250 billion/month) which will bring 4.5k financial institutions in 58 markets to tokenized RWA

Polygon’s Rio and Heimdall chain upgrades bring speeds of up to 5,000 TPS and instant finality for transactions

at the start of November, POL had the largest increase in monthly active adresses with 30%+

Sandeep isn't wasting time and he's cooperating with American lawmakers/regulator to be as compliant as posible, making the chain the perfect ground for institutional players

the bigest prediction market @Polymarket has their home base on POL L2 and they aren't planning on abandoning ship anytime soon (for good reasons) - side note Polymarket will soon be integrated with Google

even with the emergence of the new meta of L1 specialized for stablecoins, Polygon has seen a large increase of stablecoin inflows - 80%+ marketshare both in Latin America and South East Asia

final thoughts

other L2s have had their spotlight but haven't really stood the test of time

neither have they seen the adoption Polygon L2 has

moreover, Polygon has actual working products built on in whereas if you think at other L2s you can barely name 1 or 2 dApps built on their infra (at best)

Polygon redemption arc is looking good right here

로그인하면 맞춤 뉴스 물어다 줄게🦉

-

관심사 기반 맞춤 뉴스 추천

-

왕초보를 위한 AI 입문 가이드북 제공

-

부키가 물어다 주는 뉴스레터 구독

-

회원 전용 인사이트 칼럼 열람

-

둥지 커뮤니티 게시판 이용

지금 핫한 소식🚀

- 1. 챗GPT, 사용률 1위 독주 중인데 제미나이랑 코파일럿이 추격 중

- 2. 구글, 3D 가상환경서 AI 스스로 더 똑똑해지는 기술 개발했네

- 3. 퍼플렉시티, GPT-5.2 모든 유료회원에게 제공한대

- 4. 챗GPT, 똑같은 질문에도 핵심 못짚고 쓸데없는 얘기만 한다네

- 5. xAI, 엘살바도르 100만 학생에게 AI 그록 개인교사 제공한대

- 6. 제미나이, 11일 '프롬프트 잘 쓰는법' 학습자 위한 특별 이벤트 열린대

- 7. 퍼플렉시티, 챗GPT와 구글이랑 다른 점이 뭔지 알려줄게~

- 8. 런웨이, 세계 시뮬레이션할 AI 개발 중인데 곧 새 기술 공개한대

- 9. 헤이젠, 미로(Miro) 디자이너가 교육 영상 제작 수준 높였다네

- 10. 앤트로픽, MCP를 리눅스 재단 산하 에이전틱 AI 재단으로 옮겼대

부키가 물어다 주는 뉴스레터🦉

미리보기구독하면 이메일로 AI 소식과 팁들을 보내줄게!

아직 댓글이 없어. 1번째로 댓글 작성해 볼래?